About The Win The Game of Money Institute

Hello,

My name is Bob Ritchey.

I am the founder of the Win the Game of Money Institute and I would like to take a few minutes to tell you a little about myself and why I founded the institute.

When I started high school, my father, an electrical engineer, emphasized to me that the secret to financial success was to get a good education and then get a good, secure job. So I followed his advice, I studied hard and went to college.

I earned a Bachelor of Science Degree in mathematics, then I took an additional 90 college units including a Master’s Degree in Education and in 1965, I obtained a very secure job with the Kern High School District in Bakersfield, California as a high school math teacher.

In 1980, I was at the top of the salary schedule for teachers in my district and made $30,000 for the school year. My salary was based on years of experience and educational units taken, not on how great a teacher I was.

Any additional increases in my income from then on would be “Cost of Living” raises that had to be negotiated for, over which I had no control.

I would be lucky to stay up with increases in taxes and the negative effects of inflation for the rest of my teaching career.

I really enjoyed teaching but…

I was struggling to obtain the lifestyle I wanted for my family.

In 1970, I was introduced to something completely new to me – information on personal growth and development. I started reading books such as “Think and Grow Rich” by Napoleon Hill and “How to Win Friends and Influence People” by Dale Carnegie.

It was at this time that I discovered there are really three types of education and, with all the formal classes I had taken, I had only been taught two of them.

- Academic or Scholastic Education: Education that teaches how to read, write and do arithmetic.

- Professional Education: Education that teaches the skills to work for money, such as: learning to be a doctor, lawyer, plumber, secretary, electrician, teacher or real estate agent.

But you and I were never taught the third type of education in any of our formal school classes:

- Financial Education: Education with words such as cash flow, wealth, net worth, goals, assets, entrepreneur, leverage, or financial independence.

- The education that teaches us how to invest in assets and how to build businesses.

- Education that teaches us how to develop an exit strategy from our job or profession so that we have both time and money to enjoy life.

- Education that increases our self-esteem, self-image, self-confidence, self-discipline and self-reliance.

When it came to financial intelligence, I had a “kindergarten education.”

I also realized I had not been taught two other important skills necessary for me to move ahead to reach those things I wanted for myself and my family.

- How to become personally successful – the power of setting and achieving goals.

- How to make the most productive use of a precious asset we all have – time management skills.

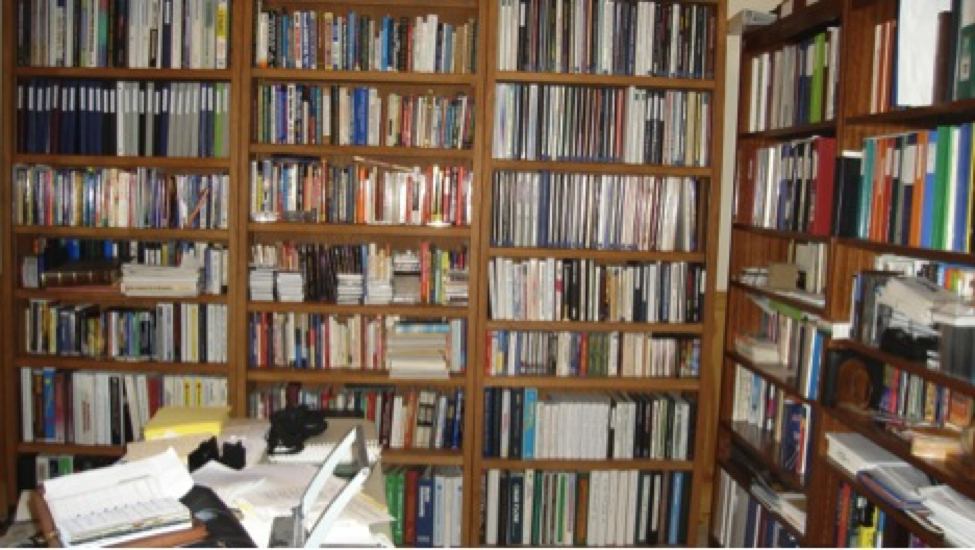

I started dedicating time, money, and effort to try to master personal and financial success. I built a personal growth and development library and started absorbing information that would educate me and motivate me to take the actions to improve in all areas of my life.

Enter Real Estate: How my whole life began to change for the better.

In 1976, I started investing in residential income property and, in 1977 I received my real estate sales license and started selling income property on a part-time basis.

In 1980, I decided to leave teaching and become a full-time real estate investment broker. All of a sudden I was in a new profession, something that required new knowledge, attitudes, habits, and skills.

It also gave me the ability to be paid exactly what I was worth, instead of what someone else said I was worth. My library became even more valuable to me.

As I continued my journey in self-improvement, striving to increase my knowledge and skills, my income also increased.

To help my real estate business, I wrote informational reports and developed educational seminars for the public on real estate investing.

One of my seminars was entitled: “How to Build a Real Estate Money Machine.” It had an evaluation form that attendees filled out and almost everyone rated the seminar as “excellent.”

What I found, though, was that a large majority of the people that attended went home and never took the action necessary to start their investment portfolio. And, I believe that’s because they did not fully understand how important it is to develop cash flow assets that would eventually create time and financial freedom.

It was at this time that I decided to create another seminar that taught the basics of financial success and financial independence. I called my seminar: “How to Win the Game of Money.”

My real estate business started to explode. Over the years, I was able to sell over 1000 residential income properties worth more than $100,000,000.

In 2000, my real estate commissions for the year totaled $458,000 and I was recognized in a full-page article as a TOP PERFORMER by the National Association of Realtors® in their magazine which is sent to approximately one million Realtors® every month.

Even though I was making great commission income every year, it was based on starting over on January 1st, trading my time for money to recreate my income.

None of the commission checks I received were “passive or residual Income,” income that would allow me to quit selling real estate and retire.

I was still in the real estate agent rat race.

However, I was also a real estate investor. In 1992, I owned 5 rental units. In 2001, I owned 98 rental units which created a great monthly cash flow and was not dependent on my time.

In 2001, I decided to build another stream of income independent of my real estate. I came across an Internet-based business that gave great tax benefits and created a very nice cash flow without investing money.

Over the next few years, my passive income from this endeavor grew to over $40,000 per year.

That may not sound like a lot of money for many people but keep in mind; this is extra, passive income that I was getting on top of my other business endeavors.

I didn’t have to slave away working long hours for that income. There’s a big difference there.

By the way, as a real estate investment broker, I know that for an individual to generate a cash flow of $40,000 per year, they would have to own at least $500,000 of investment property, free and clear.

In 2003, I had more than enough passive income to retire from selling real estate and enjoy complete time and financial freedom.

I had “won the game of money!”

In 2005, I was able to accomplish a goal that I could’ve never accomplished as a teacher. I had always wanted to move to the mountains with my family, so I purchased my dream home in beautiful South Lake Tahoe, California, for $1,015,000... cash.

While in Tahoe, I decided to fulfill what I felt was one of my ultimate passions and missions in life, teaching people through my seminars and helping them learn how to be financially successful.

I decided to create the Win the Game of Money Institute so I could share the important knowledge and experiences I had learned over the years.

In 2011 my family and I moved back to Bakersfield to be closer to other family members.

I currently own 47 residential rental units, 37 of which are free and clear and, along with my online business, generates a nice, 5-figure passive income every month.

I’m grateful to know that, if I were to die tomorrow, my wife and family’s lifestyle would remain just the same because all the income we generate is residual and not dependent upon me and my ability to trade time for money.

The information inside the Win the Game of Money Institute will provide you with your own personal growth and development system.

It will help you improve your chances of personal and financial success and move you down the road to wealth - to becoming financially independent - and allow you to Win the Game of Money for you and your family.